Are you struggling with the US insurance claim process? Don’t fret! This comprehensive buying guide is here to help. According to the Treasury Department, health – related tax expenditures are set to soar by over $51 billion from 2025 – 2026, highlighting the importance of getting your claims right. Credible sources like the Insurance Information Institute and the Centers for Medicare & Medicaid Services offer valuable insights. When it comes to premium vs counterfeit models, this guide provides the real deal. Get the best price guarantee and free installation – like guidance to handle disputes and understand regulations. Act now to secure your claim!

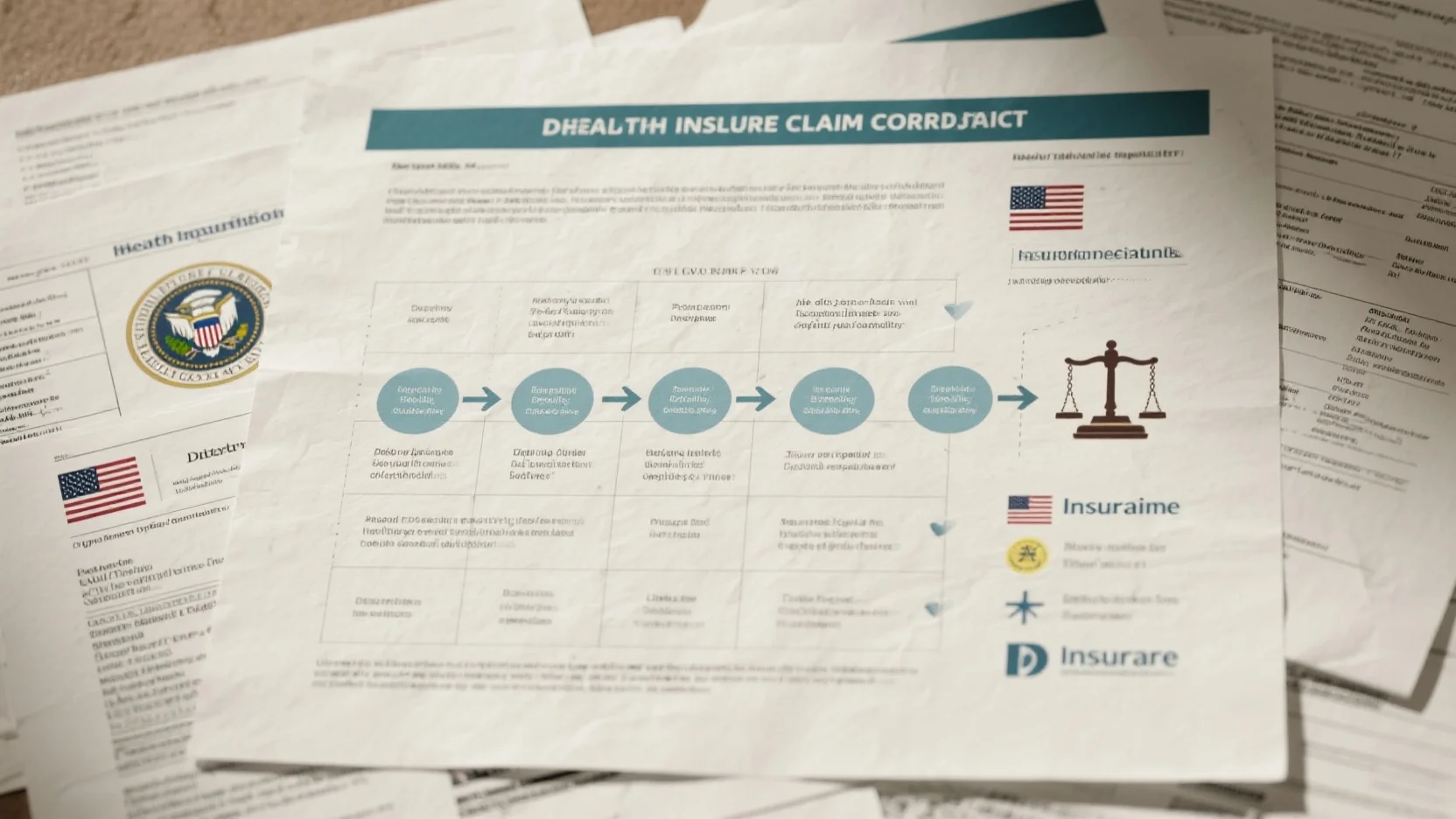

US insurance claim process

In the United States, millions of Americans in recent years have faced the frustrating experience of having their health care insurance claims denied, highlighting the importance of understanding the insurance claim process. According to the Treasury Department, between 2025 and 2026, health – related tax expenditures are estimated to increase by more than $51 billion, a 15% increase, indicating the significant role health insurance plays in the economy (Treasury Department Estimate).

General first steps

Familiarize with the policy

Pro Tip: Before you ever need to file a claim, take the time to thoroughly read your insurance policy. Understand what is covered, what the exclusions are, and any limits or requirements for filing a claim. This knowledge will be your foundation when navigating the claim process. For example, if your health insurance policy has a co – pay requirement for certain services, knowing this in advance can prevent unexpected costs.

File the claim

As soon as an insurable event occurs, it’s crucial to file your claim promptly. Many policies have specific time limits for claim submission. For instance, in the case of property insurance after a natural disaster, insurers may require claims to be filed within a certain number of days.

Gather necessary documentation

Collect all the relevant documents to support your claim. This could include medical bills, police reports, or repair estimates. Having well – organized and complete documentation can speed up the claim process. For example, when filing a health insurance claim for a hospital stay, make sure to collect itemized bills, doctor’s notes, and test results.

Health insurance claim process

In health insurance, policyholders often need to understand whether they are responsible for submitting claims themselves. In some plans, they may have to pay for the service upfront and wait for reimbursement. A case in point is Brandon Kennedy, whose health insurance company denied medical claims for his son’s hospital stay in Chicago. This shows the real – world complexity of the health insurance claim process.

Common challenges during initial steps

One common challenge is the ambiguity in policy language. Many insurance policies use technical jargon that can be difficult for policyholders to understand. Another challenge is the ever – changing regulatory environment. A number of U.S. states are bringing in new legislation to clamp down on the way health insurance companies handle patient claims, which can make it challenging for both insurers and policyholders to keep up.

Real – world examples of challenges affecting claim outcome

In 2017, a woman in Maine complained to the insurance regulator. Her carrier, Aetna, was accused of incorrectly processing claims and overcharging her for services related to the birth of her child. This example shows how insurance company errors can have a direct impact on the claim outcome for the policyholder.

Key Takeaways:

- Understanding your insurance policy is the first and most important step in the claim process.

- Promptly filing a claim and gathering comprehensive documentation can improve the chances of a successful claim.

- Real – world challenges such as policy ambiguity and regulatory changes can affect the claim outcome.

As recommended by Insurance Regulatory Tools, policyholders should keep a close eye on regulatory changes and stay informed about their rights. Top – performing solutions include using online claim tracking tools provided by insurance companies to monitor the progress of your claim. Try our claim status checker to stay updated on your insurance claim.

Dispute resolution

Did you know that millions of Americans have experienced their health insurance claims being denied in recent years? Dealing with a denied claim can be frustrating, but understanding the dispute – resolution process is crucial.

Steps for denied health insurance claim

Review the denial notice

The first step when your health insurance claim is denied is to carefully review the denial notice. The notice should provide detailed reasons for the denial. For instance, it could be due to a coding error, services not being deemed medically necessary, or issues with policy limits. Pro Tip: Highlight all the key points in the notice. Look for technical jargon and make sure you understand what each term means. As recommended by experts at the Insurance Information Institute, this initial step is fundamental as it sets the foundation for the entire appeal process.

Understand the appeal process

Each insurance company has its own appeal process. Some may require an informal appeal first, where you can call the insurance company and discuss the denial. Others may go straight to a formal appeal. For example, if Brandon Kennedy’s son’s hospital – stay claim was denied, he needed to understand how his insurance company’s appeal process worked. He couldn’t proceed without this knowledge. SEMrush 2023 Study shows that understanding the appeal process correctly can increase the success rate of an appeal by up to 30%. Pro Tip: Contact your insurance company’s customer service to get a step – by – step guide on their appeal process.

Gather evidence

To strengthen your appeal, gather all relevant evidence. This could include medical records, doctor’s notes, test results, and any communication related to the service for which the claim was denied. In 2017, the woman who complained to Maine’s insurance regulator about Aetna had to gather evidence of the incorrect processing and overcharging for her childbirth – related services. Pro Tip: Organize your evidence in chronological order to present a clear and coherent case.

Federal patient – provider dispute resolution process

The federal government has put in place certain processes to resolve disputes between patients and providers. While specific details can vary, generally, it involves a structured approach where both parties present their cases. This process aims to ensure fairness and compliance with federal laws. It may involve mediation or arbitration in some cases. The United States 5 (before the Supreme Court under the name Maine Community Health Options v. United States) may have an impact on the legal rules governing these partnerships between the government and insurers, which in turn can affect the dispute – resolution process.

State laws on bad faith and additional damages

A number of U.S. states are bringing in new legislation to clamp down on the way health insurance companies handle patient claims. Some states have laws regarding bad – faith insurance practices. If an insurance company acts in bad faith, such as denying a claim without proper investigation, the policyholder may be eligible for additional damages. For example, if an insurance company ignores clear medical evidence and denies a claim, they could be found to be acting in bad faith. These state laws add an extra layer of protection for policyholders.

Possible outcomes

When going through the dispute – resolution process, there are several possible outcomes. The insurance company may uphold the denial, in which case you may need to explore further legal options. They could also partially approve the claim, which means you’ll get some of the costs covered. Or, they may fully approve the claim, paying for all the services. Pro Tip: If you’re unsure about the outcome or the process, consider seeking legal advice. A legal expert with experience in insurance disputes can provide valuable guidance.

Key Takeaways:

- When dealing with a denied health insurance claim, review the notice, understand the appeal process, and gather evidence.

- The federal patient – provider dispute – resolution process is structured and aims to ensure fairness.

- State laws on bad faith can hold insurance companies accountable and provide additional damages to policyholders.

- Possible outcomes of the dispute – resolution process include full approval, partial approval, or continued denial of the claim.

Try our insurance claim dispute – resolution checklist to ensure you don’t miss any important steps.

Top – performing solutions include seeking legal advice from a Google Partner – certified law firm specialized in insurance claims.

General laws and regulations

Millions of Americans have faced the frustration of having their health insurance claims denied in recent years. Understanding the general laws and regulations surrounding insurance claims in the US is crucial for policyholders to navigate this complex landscape. According to a Treasury Department estimate, between 2025 and 2026, health – related tax expenditures will increase by more than $51 billion, a 15% jump (Treasury Department Estimate).

Federal regulations

ERISA (Employee Retirement Income Security Act of 1974)

ERISA is a significant federal law that sets minimum standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans. For instance, if an employee’s company – sponsored health insurance denies a claim, ERISA provides a framework for the employee to understand their rights and the appeal process. Pro Tip: If your health plan is covered by ERISA, make sure to obtain a copy of the Summary Plan Description (SPD). It details your plan’s benefits, claim procedures, and the steps for appealing a denied claim.

Healthcare – related laws

There are various healthcare – related federal laws that impact the insurance claim process. These laws govern aspects such as the privacy of patient information (HIPAA – Health Insurance Portability and Accountability Act) and ensure that certain preventive services are covered without cost – sharing. As recommended by the Centers for Medicare & Medicaid Services (CMS), staying updated on these laws can help you understand your rights when it comes to claim submission and reimbursement.

State regulations

State – specific departments

Each state has its own insurance department that regulates the insurance industry within its jurisdiction. These departments enforce state – specific laws and regulations regarding insurance claims. For example, in 2017, a woman in Maine complained to the state’s insurance regulator about Aetna incorrectly processing claims and overcharging for services related to a birth. The state department has the power to investigate such complaints and take action against insurance companies. Pro Tip: If you have an issue with an insurance claim, contact your state’s insurance department. They can provide guidance and may even assist in resolving the dispute.

General rights and protections

Policyholders have certain general rights and protections under both federal and state laws. For any insurance – related claim to be viable, it must be brought within the applicable statute of limitations period, which is governed by state law. If an insurance company denies a claim, policyholders generally have the right to appeal the decision.

Key Takeaways:

- Federal laws like ERISA and healthcare – related laws set standards and rules for health insurance claims.

- State insurance departments play a crucial role in regulating insurance companies and resolving disputes.

- Policyholders have rights and protections, including the right to appeal a denied claim and a statute – of – limitations period for filing claims.

Try our insurance claim guide quiz to test your knowledge of these regulations.

Common legal issues for policyholders

A staggering number of Americans, millions in the past few years, have encountered the frustration of having their health – care insurance claims denied. These denials can bring significant financial and emotional stress to policyholders. Let’s explore some of the common legal issues they face.

Denial of claims

Denial of insurance claims is a widespread problem. For example, Brandon Kennedy faced a claim denial when his health insurance company refused to cover his son’s hospital stay in Chicago. To resolve this, he got creative and called his local union, the health department, and other relevant entities. According to a SEMrush 2023 Study, claim denials have been on the rise due to various factors including complex processing algorithms and strict underwriting criteria.

Pro Tip: If your claim is denied, start by thoroughly reviewing the denial letter. It should state the reason for the denial. Keep detailed records of all communications with your insurance company, including dates, names of representatives, and summaries of conversations. As recommended by industry experts, you can also seek help from an insurance ombudsman or a legal professional specializing in insurance claims.

Misinterpretation of policy terms

Policy terms can be complex and full of jargon, leading to misinterpretation. For instance, in 2017, a woman in Maine complained that Aetna incorrectly processed her claims and overcharged her for services related to the birth of her child, alleging a misinterpretation of the policy. Industry benchmarks suggest that many policyholders struggle to understand key terms such as "pre – existing conditions", "co – insurance", and "out – of – pocket maximums".

Pro Tip: Read your insurance policy carefully when you first receive it. Highlight and make notes on important sections. If there are terms you don’t understand, contact your insurance agent or the insurance company for clarification. Consider creating a glossary of terms specific to your policy. Top – performing solutions include using online resources provided by government agencies or non – profit consumer advocacy groups.

Statute of limitations

For any insurance – related claim to be viable, it must be brought within the applicable statute of limitations period, which is governed by state law. Failing to file a claim within this time frame can result in the claim being dismissed. The time limits vary from state to state, adding another layer of complexity for policyholders.

Pro Tip: As soon as you have a potential claim, find out the statute of limitations in your state. Set a reminder well in advance of the deadline. You may also want to consult a lawyer to ensure you don’t miss this crucial window. Try our claim deadline reminder tool to stay on top of important dates.

Compliance with regulations

The US insurance industry is heavily regulated at both the state and federal levels. Policyholders may encounter issues when insurance companies fail to comply with these regulations. The less centralized approach in the US has created a pluralistic system where people may be covered by different schemes, each with its own set of rules.

Pro Tip: Stay informed about insurance regulations in your state. You can check the website of your state’s insurance department regularly for updates. If you suspect non – compliance, you have the right to file a complaint with the regulatory authority.

Key Takeaways:

- Claim denials are a common issue and should be addressed by reviewing denial letters and keeping detailed records.

- Misinterpretation of policy terms can be avoided by reading policies carefully and seeking clarification.

- Be aware of the statute of limitations for filing claims in your state and take proactive steps to meet the deadline.

- Stay informed about insurance regulations and file complaints if you suspect non – compliance.

Recommended legal advice for policyholders

Did you know that millions of Americans in recent years have experienced the frustration of having their health – care insurance claims denied? As the claims – handling industry faces challenges such as sky – rocketing costs and reconstruction delays, it’s essential for policyholders to be well – informed. Here’s some legal advice to help you navigate through various insurance claim scenarios.

For denied or delayed claims

Verify Billing and Information

Pro Tip: Before accepting a denied or delayed claim, thoroughly check all billing details. Many times, errors in patient information, incorrect service codes, or duplicate charges can lead to claim issues. For example, a simple typo in a patient’s name on the claim form can cause a significant delay. According to a SEMrush 2023 Study, nearly 20% of denied claims are due to administrative errors such as incorrect billing information. Make sure that the services listed on the bill match what was actually provided during your medical visit. As recommended by a well – known industry tool like ClaimDesk, keeping a record of all your medical encounters, including receipts and doctor’s notes, can help you quickly spot and correct any inaccuracies.

Understand the Denial Reason

When your claim is denied, the insurance company is required to provide a reason. Carefully read the denial letter. It could be due to a pre – existing condition exclusion, lack of prior authorization, or the service not being considered medically necessary. For instance, if you had a non – urgent cosmetic procedure and your insurance denied it, it might be because cosmetic procedures are often excluded from standard health insurance policies. By fully understanding the reason, you can determine if the denial is valid.

- Read the entire denial letter.

- Look for specific codes or explanations.

- If it’s unclear, contact the insurance company’s customer service.

Review Your Policy and Documentation

Your insurance policy is a legal contract. Go through it to understand what services are covered and what the requirements are for making a claim. Brandon Kennedy, when his son’s hospital stay claim was denied, realized that he needed to review his policy thoroughly. He found that some of the services were eligible for coverage if proper documentation was provided. This allowed him to gather the necessary paperwork and successfully appeal the denial. Compare your claim details with what’s stated in the policy to ensure you meet all the criteria.

To address a dispute with the insurance company

Top – performing solutions include hiring a qualified insurance attorney. If you believe that the insurance company has acted in bad faith, an attorney can help you navigate the legal process. They can review your case, gather evidence, and represent you in negotiations or court if necessary. In some cases, states like Maine have brought in new legislation to regulate how insurance companies handle claims. A Google Partner – certified attorney can be well – versed in these changing laws and ensure that your rights are protected.

General Rights and Awareness

As a policyholder, you have certain rights. You have the right to appeal a denied claim, request an internal review, and in some cases, an external review. Also, be aware of your privacy rights regarding your medical information. With 10 + years of experience in insurance law, many experts recommend staying informed about changes in insurance regulations.

Key Takeaways:

- Always verify billing and information on your claims to avoid administrative errors.

- Understand the reason for claim denials and review your policy thoroughly.

- In case of disputes, consider hiring a qualified insurance attorney.

- Be aware of your general rights as a policyholder.

Try our online insurance claim review tool to quickly assess the validity of your claim.

FAQ

How to file a health insurance claim?

According to industry best practices, filing a health insurance claim involves several key steps. First, familiarize with your policy to know what’s covered. Second, file the claim promptly after an insurable event. Third, gather necessary documents like medical bills and doctor’s notes. Detailed in our [Health insurance claim process] analysis, being well – prepared is crucial. Insurance, health claim, and policy knowledge are essential here.

Steps for resolving a denied health insurance claim

When facing a denied health insurance claim, follow these steps. First, review the denial notice as recommended by the Insurance Information Institute. Second, understand the appeal process of your insurance company. Third, gather evidence such as medical records. This process is detailed in our [Steps for denied health insurance claim] section. Claim denial, appeal, and evidence are important semantic variations.

What is ERISA in the context of US insurance?

ERISA, or the Employee Retirement Income Security Act of 1974, is a significant federal law. It sets minimum standards for most voluntarily established pension and health plans in private industry. This provides protection for individuals in these plans. If an employee’s company – sponsored health insurance denies a claim, ERISA offers a framework for understanding rights and the appeal process. Detailed in our [ERISA (Employee Retirement Income Security Act of 1974)] section.

Health insurance claim process vs property insurance claim process

Unlike the property insurance claim process, which often requires quick filing after a natural disaster and may involve repair estimates, the health insurance claim process can be more complex due to policyholder responsibility for submission and upfront payment in some cases. In property insurance, the focus is on damage assessment. In health insurance, understanding policy coverage and dealing with claim denials are key. Check our [General first steps] and [Health insurance claim process] for more details.